Finding the perfect house for sale in Nigeria can be both exciting and overwhelming, especially for first-time home buyers or property investors.

The country’s real estate market presents a broad spectrum of options—from luxurious homes in high-end areas to more affordable properties in up-and-coming neighborhoods. With such variety, it’s easy to feel overwhelmed by the choices, but taking the time to plan properly is essential for making an informed decision.

🚨 December Exclusive Deals Are Here! 🚨

Hurry, limited slots available! Packages are selling out fast!

Book your staycation today and save BIG on our top packages.

Bronze Package (3 days) Limited Slots

4 Bedroom Shortlet🏠 Location: Lekki, Victoria Island, Ikoyi

Enjoy a weekend getaway with Silent Disco, BBQ Night, and Free Breakfast.

Only $2,500 $3,000

Silver Package (5 days) Limited Slots

Luxury 4 Bedroom Shortlet🏠 Location: Lekki, Victoria Island, Ikoyi

Includes chef dining, Silent Disco, BBQ Night, and premium concierge services.

Only $4,250 $5,000

Gold Package (7 days) Limited Slots

Exclusive 4 Bedroom Shortlet 🏠 Location: Lekki, Victoria Island, Ikoyi

Luxury at its finest with chef dining, Sip & Paint, Silent Disco, and VIP bookings.

Only $5,700 $6,000

Whether you’re in search of a home to settle into or looking for a lucrative investment property, this guide will help you confidently navigate the Nigerian property market. By following these steps and using practical tips , you’ll be better equipped to find the house that best suits your needs and goals.

1. Determine Your Budget

The first step in buying a house is understanding your financial capabilities. You don’t want to overspend or stretch your finances too thin, only to face difficulties later. Your budget will determine the type, location, and size of the property you can afford. Assess your savings, income, and available financing options to set a realistic budget.

Krent is a real estate platform in Nigeria. Whether you're looking to buy, rent, or short let a house, apartment, land, or commercial space, check out our listings. You can also request specific properties.

Key Tips:

- Get pre-approved for a mortgage: This helps you understand how much the bank is willing to lend based on your financial profile.

- Include other costs: Don’t forget about additional expenses such as stamp duties, legal fees, survey plans, and agency fees.

- Down payment: Most sellers expect at least a 20-30% down payment for the property.

2. Define Your Property Requirements

Before starting your search, clearly define your needs and preferences. Consider factors such as location, the type of house you want (bungalow, duplex, terrace, or detached), number of bedrooms, and amenities.

Key Considerations:

- Location: Choose an area based on proximity to work, schools, hospitals, and access to major roads. In Nigeria, popular areas like Lekki, Ikoyi, and Victoria Island in Lagos, or Asokoro, Gwarinpa, and Maitama in Abuja, are highly sought after. Your budget and lifestyle preferences will play a big role in determining the right location.

- Size and Style: Consider the size of the house based on your family’s needs and lifestyle. Duplexes, bungalows, and apartments are common options.

- Amenities: Prioritize features such as parking spaces, security, water supply, electricity, and internet connectivity.

3. Start Your Property Search

Once your budget and preferences are clear, begin your property search. There are several channels available for finding houses for sale in Nigeria, each with its own advantages.

Common Methods:

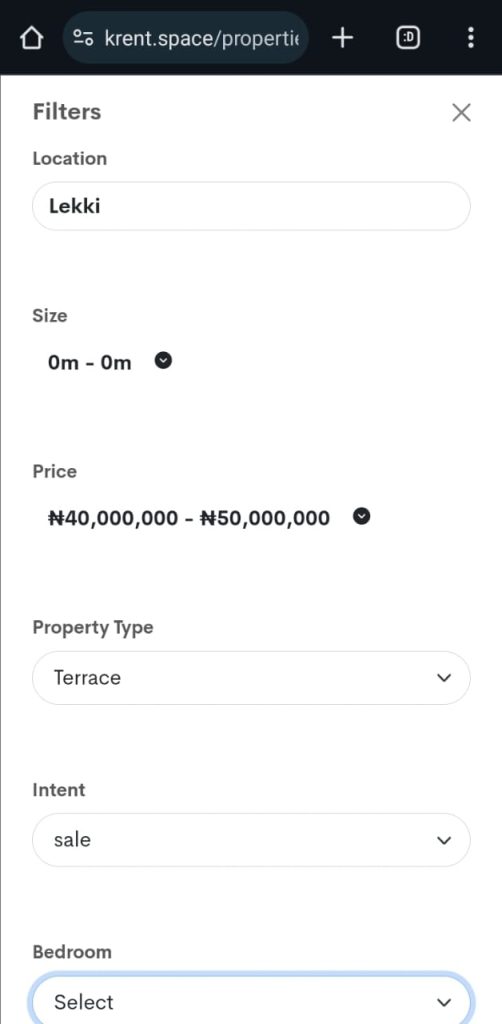

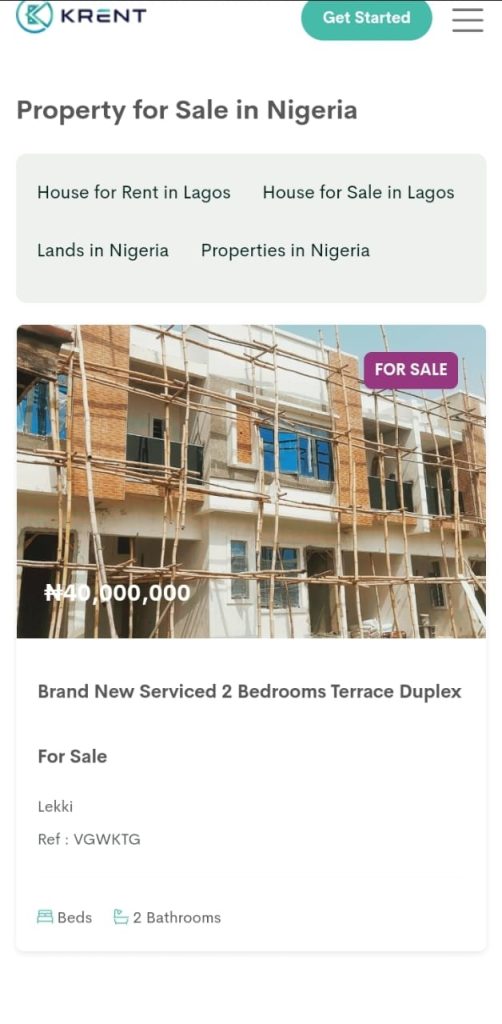

- Online Real Estate Portals: Websites like Krent.space have made the search for properties much easier. These platforms offer filters that allow you to narrow down options based on location, price, and property type. On Krent, you can easily input your preferences and search for properties that match your criteria, whether it’s a bungalow, maisonette, or terrace.

- Estate Agents: Work with trusted and registered estate agents who have local expertise. Ensure they are licensed by organizations like the Nigerian Institution of Estate Surveyors and Valuers (NIESV).

- Word of Mouth: Ask friends, family, or colleagues for property recommendations. Word of mouth is still a powerful tool in Nigeria’s real estate market.

4. Property Inspection

After shortlisting potential houses, schedule property inspections. This step ensures that the property matches the description and photos you’ve seen online. On platforms like Krent, you can view a 3D virtual tour of the property, allowing you to explore the space in-depth before committing to an in-person visit.

During Inspection, Pay Attention To:

- Structural Integrity: Look out for cracks, leaks, and any signs of water damage.

- Property Size: Ensure that the room sizes and overall layout meet your needs.

- Security: Check for security features like gates, fences, CCTV cameras, and the general safety of the neighborhood.

- Utilities: Confirm the availability of essential utilities like water supply, electricity, and drainage systems.

Consider visiting the property at different times of the day to assess traffic patterns, noise levels, and the overall activity in the neighborhood.

5. Conduct Due Diligence

Before making an offer, it’s crucial to perform thorough due diligence to ensure the property is legally sound and free from disputes.

Key Steps:

- Verify Ownership: Review title documents like the Certificate of Occupancy (C of O), Deed of Assignment, or Governor’s Consent to confirm the seller’s ownership.

- Check Land Use: Ensure the property complies with zoning regulations. Some areas may restrict certain types of buildings.

- Seek Legal Advice: Hire a real estate lawyer to help with the verification process and draft agreements. Some real estate platforms offer in-house legal services to assist with due diligence, ensuring that the property meets all legal requirements.

6. Make an Offer

Once you’re satisfied with the property and its legal standing, the next step is to make an offer. Your offer price should be based on your budget and the property’s market value.

Negotiation Tips:

- Research Comparable Sales: Check how much similar properties in the area have sold for to avoid overpaying.

- Negotiate Smartly: Be prepared to negotiate the price. Many sellers price their properties with room for negotiation.

7. Finalizing the Purchase

After agreeing on the price, you’ll enter the final stage of the purchase process.

Key Steps:

- Deposit Payment: Make the down payment as agreed in your contract.

- Sign the Deed of Sale: This document legally transfers ownership of the property to you. Ensure that it is signed and witnessed by a legal professional.

- Obtain Necessary Documents: Collect documents like the Deed of Assignment, Certificate of Occupancy (C of O), and Survey Plan.

- Register the Property: Ensure the property is registered at the Land Registry for official recognition of ownership.

Things to Consider After Purchase:

- Renovations: Depending on the condition of the property, you may need to plan for renovations or upgrades.

- Utility Connection: Arrange for essential services such as electricity, water, and internet before moving in.

- Property Management: If the property is for investment, consider hiring a property management firm to handle tenant issues and maintenance.

Conclusion

Finding a house for sale in Nigeria can be a complex process, but with careful planning and attention to key factors, you can make a well-informed decision. From defining your budget to conducting due diligence and ensuring proper legal procedures, every step is crucial for a successful purchase. Whether you’re looking for a home to live in or an investment property, staying diligent and using the right tools will set you on the right path.

If you’re looking for a stress-free experience, Krent is here to simplify your property search. With our platform, you can browse verified listings, enjoy 3D virtual tours, and benefit from a third-party team that inspects properties to ensure they meet quality standards. Let Krent help you find your ideal home, with peace of mind at every step.